Car insurance in Michigan is not cheap. In fact, Michigan is one of the most expensive states to purchase automobile insurance in the country. Next month, car insurance companies can begin to offer no-fault policies with limited PIP coverage that will allegedly decrease the cost of car insurance.

However, Coronavirus has also changed the way auto insurance in Michigan should be charged.

A few weeks ago, I received a refund from Citizens Insurance for part of my auto no-fault policy. The refund is related to the pandemic, as the number of motor vehicle crashes and claims have decreased dramatically since the start of the pandemic in March.

As I previously wrote about, insurance carriers throughout the nation have been under a lot of pressure from state regulators to issue refunds to policyholders due to the dwindling number of Michigan car accident claims. The insurance industry has reaped billions in profits during the second quarter, and the amount of claims paid are well below historical averages due to the pandemic.

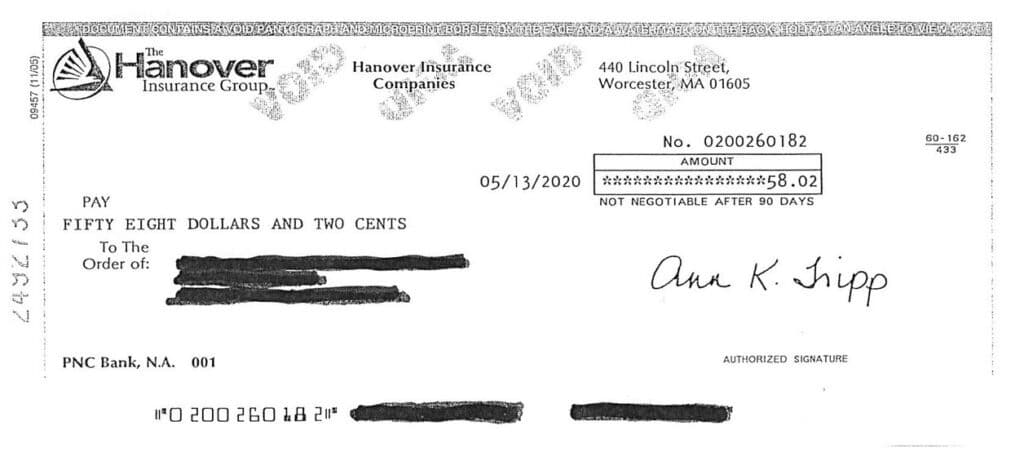

Well, I got my refund and I must say it was very disappointing. As the check here shows, the total amount of the refund was $58.02. This despite the fact I pay well over $2,000 for car insurance to insure two automobiles at my house every six months. Given I have been working mostly from home over the past 2+ months, and my wife has probably driven her vehicle less than 50 miles since mid-March, one would think a larger refund would be warranted.

But that does not appear to be the case. Instead, Citizens Insurance offered what amounts to less than a 3% refund. The amount of this refund is complete unreasonable. Yes, there are risks that car insurance carriers face from having a vehicle just sit in a driveway. But the risks that auto insurance companies like State Farm, Allstate and Geico insure mostly derive from vehicles on the road. And with so few cars on the road, the amount of claims paid this year have dried up.

Because of this economic reality, the rate of refunds must be higher.

This week, an order issued by the Michigan Department of Insurance and Financial Services (DIFS) requires auto insurance companies to submit filings that include a proposed refund or premium waiver by June 10. That is a good first step. However, DIFs does not state (1) how much the refunds or waivers must be or (2) when customers will receive these payments.

It would be nice if DIFS actually issued an order with some teeth. Car insurance companies offering customers savings in the amount of a few percentage points during a time of economic collapse and extreme financial hardship is a slap in the face to all Michigan motorists and policyholders. The only way auto carriers will actually pay their fair share is if regulators, like the state of Michigan and DIFS, orders them to do so.

Unfortunately, it seems DIFS is unwilling to do this for its citizens. Instead, we will have to pay for insurance we don’t need and in many circumstances, couldn’t even use because of the shelter-in-place order.

It is this author’s opinion that the State can and must do better.