Michigan Assigned Claims Plan – How To Complete the Application for Benefits

When you are injured in a car or truck accident in Michigan, or even if you are on a motorcycle and a car or truck was involved in causing the accident, you are almost always entitled to Michigan no-fault benefits. These benefits include the payment of hospital bills, doctors’ bills, lost wages, prescriptions, transportation and other benefits. These benefits are called personal injury protection (PIP) benefits.

Michigan’s no-fault law has undergone a lot of changes when reforms were made in 2019. Under the law, no longer do all auto insurance policies carry unlimited medical PIP coverage. Now people can select less protective policies that limit your medical coverage. In addition, the new law has changed which insurance carrier is responsible for paying these Michigan no-fault benefits.

If you are injured in a car accident, your own car insurance pays the medical expenses that health insurance does not cover under your PIP coverage. So if you have Allstate Insurance, Allstate pays your PIP claim. If you don’t have auto insurance, but you live with a resident relative who does – like a sibling, parent or child – then their auto insurance carrier will pay your claim. This is true even if that car or truck was not involved in the car collision.

But for those people who are injured and do not have auto insurance in the household, then there is an alternative. Under the law, the Michigan Assigned Claims Plan, or MACP, is next in line to pay for your auto accident-related injuries. The MACP is administered by the Michigan Automobile Insurance Placement Facility. This entity is controlled by the state and its member car insurance carriers.

Under the Plan, an injured person must complete and return an “Application for Benefits” within one year of the car accident. The application must be completed properly and signed. Upon receipt, the MACP will then assign a car insurance carrier – such as Farm Bureau or Allstate – to pay the no-fault benefits.

Under the new law, the assigned car insurance company is obligated to pay up to $250,000 in PIP benefits, such as medical expenses.

This article is about the Application for Benefits and how to complete this very important document. What was once a short two-page application so now turned into a five-page questionnaire with almost 50 questions and subparts.

What is an Application for Benefits under the MACP?

First, a quick explanation about what the Application for Benefits is under the MACP. Under MCL 500.3172(3), a person entitled to PIP benefits must complete an application on a claim form provided by the Michigan automobile insurance placement facility. The claim form includes a series of questions about the claimant’s personal information, accident information, injuries, health insurance, employment and vehicle ownership. The claim form, or Application for Benefits, can be downloaded from https://www.michacp.org/documents/ACF01.pdf or completed online at https://www.michacp.org/file-claim.aspx.

How to Complete the Application for Benefits

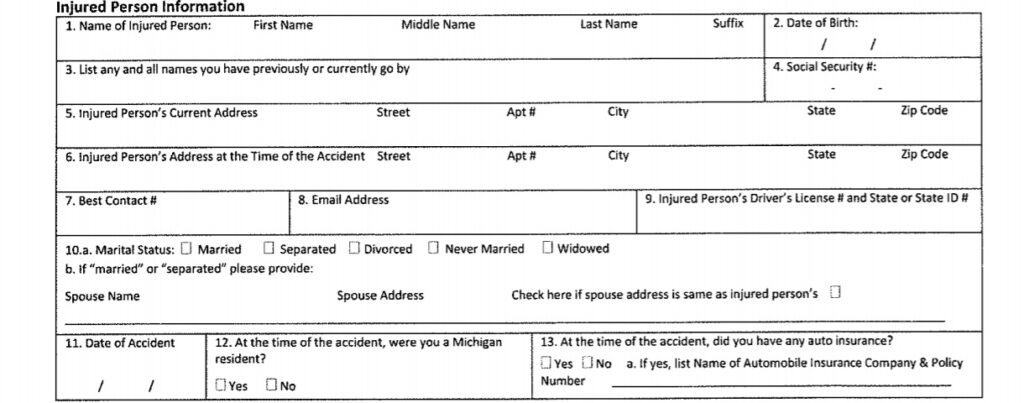

The Application for Benefits for the MACP is broken up into specific parts. The first part asks about the injured person’s personal information. Make sure to fill this out completely. Give the full, middle and last name. Include the current address of the injured person as well as where he or she lived on the date of the crash. Don’t forget to include the social security number and the injured person’s driver’s license number or State ID. Where it asks if you had auto insurance at the time of the accident, check the NO box if this is accurate.

Accident Information

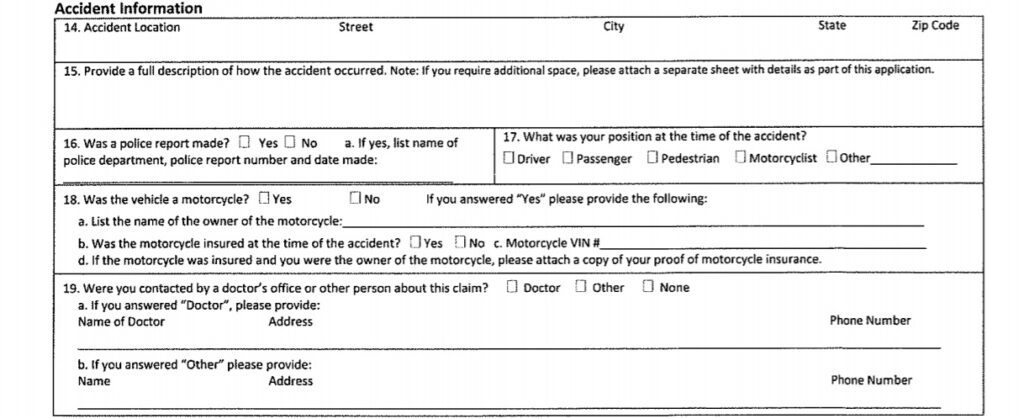

Next, the Application will ask questions about the accident itself. Again, you need to be as detailed as possible. Don’t leave anything required blank. If a police report was made, be sure to give the report number which is usually found in the upper right-hand corner of the traffic crash report. Provide where you were sitting in the vehicle when the crash occurred and whether or not a motorcycle was involved.

Injury Information

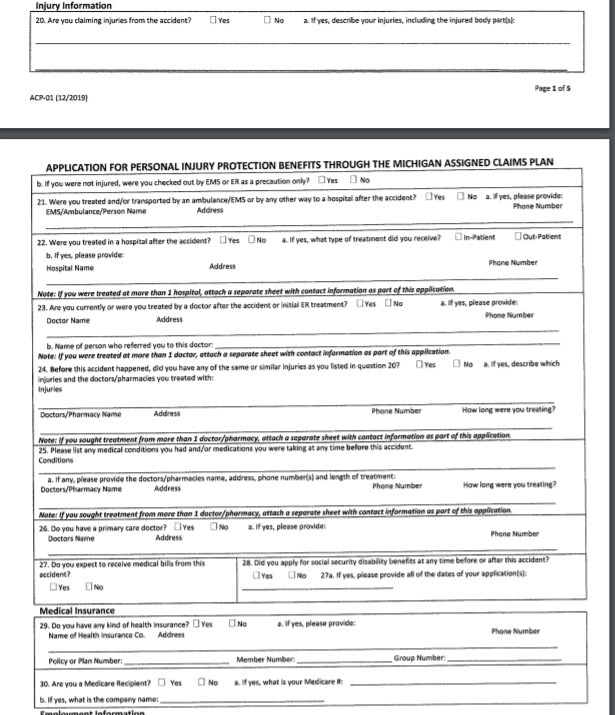

The next section asks about the claimant’s injuries. Be as detailed as possible. If you have multiple injuries, make sure to list them all out. If you fail to include certain injuries, the insurance company may hold that against you later. Include which hospital you went to, if any, after the accident and the names, addresses and telephone numbers of ALL doctors or medical facilities that have treated you since the crash.

As the application indicates, if you were treated by more than 1 doctor, attach a separate sheet with their contact information. Do not forget to do this.

This section will also ask you about similar injuries before the accident. Again, be truthful and do not leave anything out. If you injured your low back in the car accident but were treated for low back pain before the accident, you must mention this and then list the name and address of the doctor who treated you for this condition. Also include the name of the pharmacy you used before the car accident and how long you have been treating these ailments.

The next question asks you to list any medical conditions you had and/or medications you were taking at any time before this accident. This question has to do with your health before the accident that is unrelated to the injuries you sustained in the accident. Again, don’t leave anything out. This part should almost never be blank because we’ve all had issues in the past with our health. List out all your ailments, whether it’s high blood pressure, diabetes, an injured shoulder or headaches. Then provide the name, address and telephone number of the doctors you saw for these ailments. Also, don’t forget to include the pharmacy and the medications you were on.

Important Note – Failing to do this can be catastrophic for your claim. The insurance company can claim fraud if you fail to disclose similar injurie you had before the accident that you are claiming from this accident. In fact, under MCL 500.3173a(4), your entire insurance claims can be dismissed if you fail to disclose this information on the Application for Benefits.

It is this author’s opinion that this particular section is too onerous and asks for too much information from car accident victims who are simply trying to make a PIP claim. Yes, the insurance company is entitled to know and learn about your medical history so it knows if something is auto accident-related, but this is just the application process, not the claims handling stage.

Still, we have no choice. You must complete this section as accurately and thoroughly as possible. If you don’t, the insurance company can use this to deny your claim and dismiss your lawsuit.

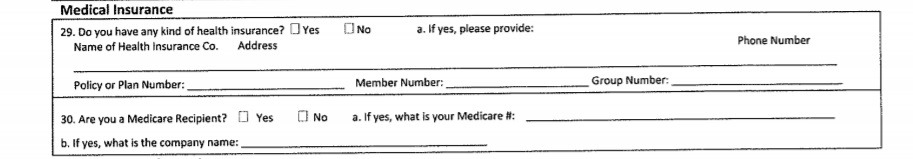

Medical Insurance

Next, the application will ask the claimant about health insurance. Again, fill this out as accurately as possible. If you are on Medicare or Medicaid, please mark that box and provide your Medicare number or Medicaid number.

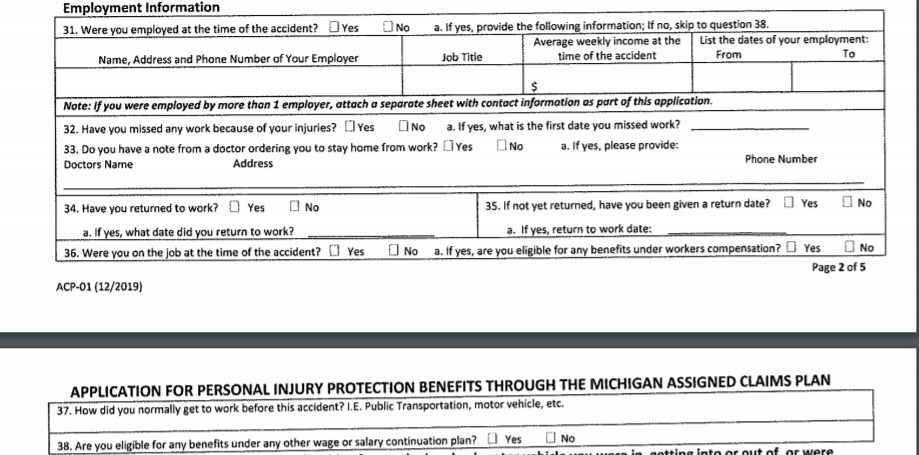

Employment Information

Under the Michigan no-fault law, the MACP must pay you 85% of your lost wages for up to 3 years from the date of the accident. As a result, they are entitled to know your employment situation at the time of the crash. Include all your employment information, including your wage rate and dates of employment. If you had more than one employer at the time of the crash, provide that information on a separate sheet with the contact information (name, address and telephone number).

The application will ask you how you got to work before the accident, so make sure you answer that. If a friend or co-worker drove you to work, or you took the bus, just write that down.

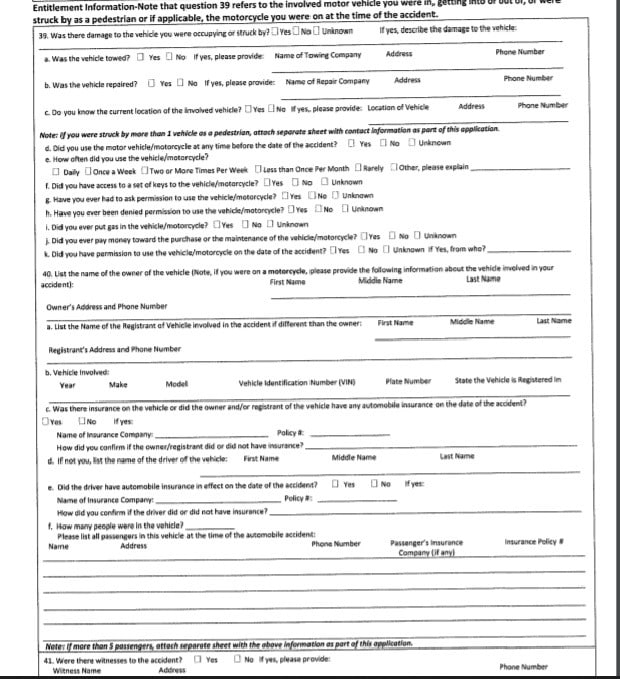

Entitlement Information

This is a very important section. This is the section that explains to the MACP why it is even getting involved with your case to begin with. Remember, the MACP is basically the insurance company of last resort. It assigns an insurance company to pay your claim when no other auto carriers are eligible to pay. This section seeks to eliminate those other options.

It is this author’s opinion that MACP asks irrelevant questions in this section as well. Again, this is the application for benefits, not the claims stage for the insurance company. But under Michigan law, you must answer the questions that are asked.

If you don’t know the answer to some of the questions here it is okay to say that. But do your best to provide information of the owner and driver of the vehicle you occupied when the crash occurred and any auto insurance they may have had. Most importantly, you must accurately list all individuals you lived with, in your home, at the time of the accident as well as vehicles owned by you, your spouse (even if you are separated), or any relative living with you on the date of the accident.

Make sure you list everyone. If you need an additional sheet, use it and include their information. Failing to be accurate can be fatal to your claim down the road.

This section will ask you if you are filing a claim with the MACP because there is a dispute between two or more insurance companies. This occurs when a person has two insurance carriers in the household or there are two carriers in the same order of priority. This rarely happens so most of the time the answer to this question is No.

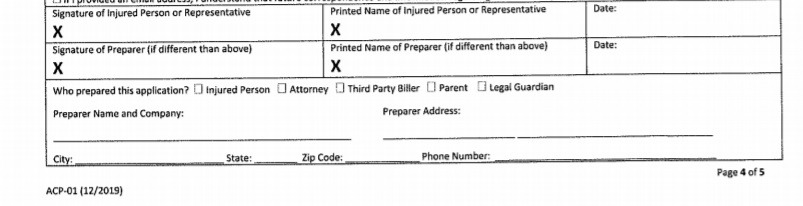

Signature Pages

At the end of the Application of Benefits, you will be asked to mark the boxes indicating you have reviewed the application and can attest the information contained in it is true and accurate. Make sure you check all four of the boxes, including the two under the Fraud Warning.

After that, sign your name, print your name and date the Application. If you prepared the application yourself, check the box that says “Injured Person” and write down your name, address and telephone number.

Make sure this section is complete. Failing to sign or date will result in a delay in processing your application. This will result in slowing down your ability to obtain much-needed benefits like lost wages and the payment of medical bills by months.

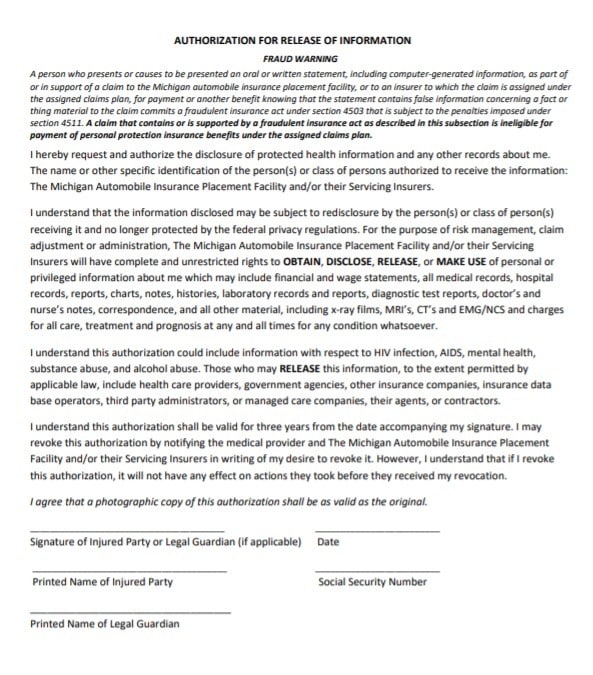

Authorization for Release of Information

This is the last part of the Application for Benefits. You must sign and date the authorization. It allows the MACP to order your medical records so it can obtain your medical information to see what is related to the auto accident and what treatment is not auto-related. Under the law, if you want the MACP to pay your claim, you must sign and date this authorization. In addition, don’t forget to date and print your name.

Additional Documents for the MACP

Along with the Application for Benefits, the Michigan Assigned Claims Plan is also entitled to documentation that shows “reasonable proof of loss.” This includes paperwork that outlines your medical treatment, injuries, disability, and other evidence showing you incurred benefits because of the car accident.

Typically, an application will include the following documentation along with their Application for Benefits:

- A copy of the police report

- A list of all medical providers seen since the accident, including their names and addresses

- Disability scripts from doctors

- Wage loss information, such as pay stubs

- ER records

The Lee Steinberg Law Firm is Here to Help

With the changes in the law, the Michigan Automobile Insurance Placement Facility through the Michigan Assigned Claims Plan is handling more Michigan no-fault PIP claims than ever before. And the new law provides the MACP with unprecedented power to control how a claim is made and how they are paid.

What was once a two- or three-page questionnaire has turned into a multi-page interrogation. And failing to provide information can result in lawyers for the insurance company alleging fraud and denying your case.

If you have any questions about the MACP or the Application process, call the Michigan car accident lawyers at the Lee Steinberg Law Firm. Our team of Michigan auto accident attorneys are ready to assist. Call us toll-free at 1-800-LEE-FREE (1-800-533-3733). We are here to help and never charge anything until we get you money for your injuries.